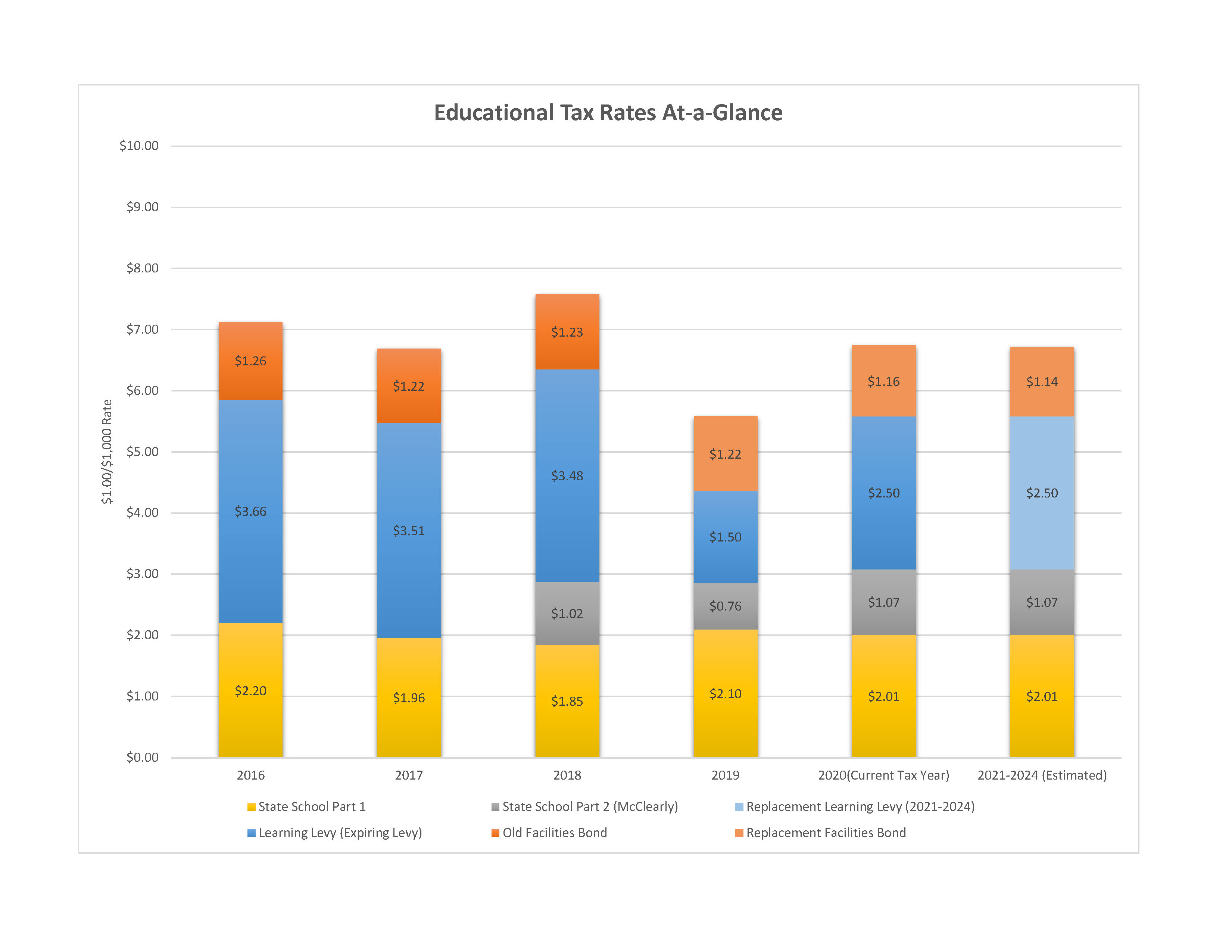

Breaking Down Educational Tax Rates

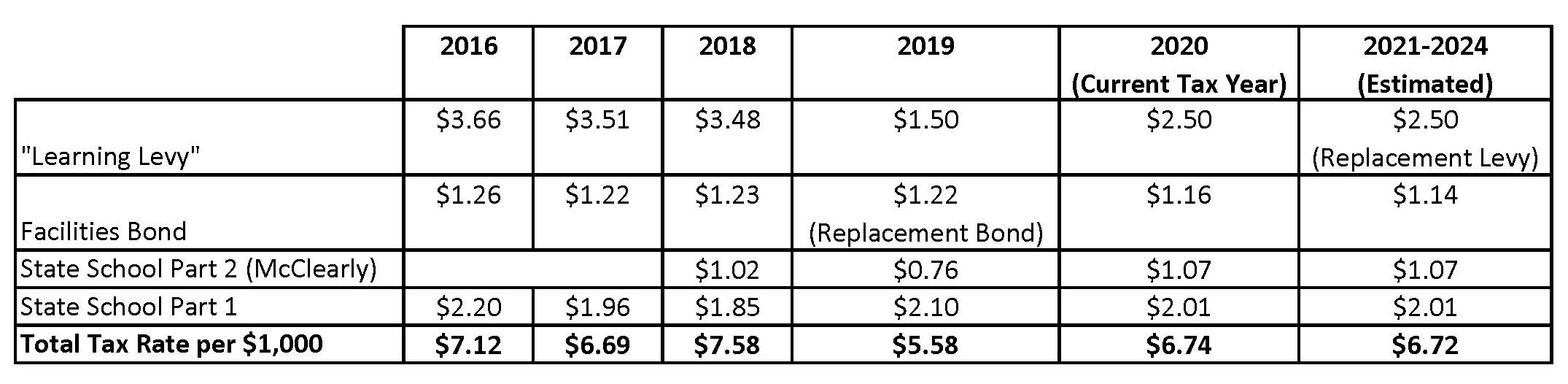

As taxpayers across the state of Washington receive their 2020 tax statements, many constituents are feeling the "see-saw" effect of the legislature's "McCleary" enactment. Over recent years, lawmaker decisions have resulted in wild swings in state and local rates. Although taxpayers in Walla Walla Public School's jurisdiction are paying a similar, and in many cases lower combined education rates post McCleary versus Pre-McCleary(see table below), the significant up and down swings make it difficult to put into perspective.

Following is a brief review of the legislative decisions and how they have influenced local tax rates over recent years.

2017 Tax Year and Earlier (Pre-McCleary)

In 2017, Walla Walla taxpayers paid a combined educational rate of $6.69/$1,000 assessed ($7.12/$1,000 the prior year). This consisted of:

- The State School Rate ($1.96/$1,000) that is set by law, assessed locally, and sent to Olympia to pay for education statewide

- A locally-approved "learning levy" rate of $3.51/$1,000 that provided student enrichment activities not funded by the state

- A school facilities bond rate that paid for long term debt for new school construction and large renovation projects (e.g. Edison Bond)

2018 Tax Year (Preliminary McCleary Impact)

In 2018, the McCleary decision began its first step in influencing how schools are funded statewide. All voters realized an increase in taxes statewide with the inception of the State School Part 2 assessment. As justified by the legislature, this new assessment (which increased taxes locally by $1.02/$1,000) would be offset the following tax year with a reduction in local levies for many jurisdictions, capping most local school levies at a maximum rate of $1.50/$1,000.

2019 Tax Year (McCleary Changes)

In 2019, many taxpayers statewide realized a significant drop in tax rates. Not only were local levies capped at $1.50/$1,000 ($2.00/$1,000 less than Walla Walla voters approved in their 2016-2020 levy rate), the state legislature also enacted a one-time, temporary decrease in the new McCleary tax (State School Part 2). This temporary relief was implemented due to outcry from taxpayers, primarily on the west side of the state, who were not going to realize a reduction in local levy rates (many urban district levy rates were less than the new cap due to their high assessed values). As a result, Walla Walla taxpayers benefited from both decisions, realizing one of the lowest combined educational rates in recent history.

2020 Tax Year (Current Tax Year) (Continued McCleary Adjustments)

During the 2019 legislative session, based on overwhelming outcry statewide from districts over the significant loss in local revenue due to the arbitrary $1.50/$1,000 levy cap, the legislature revised the lid on local levies, raising it to $2.50/$1,000. The new $2.50 local levy cap, although $1.00 higher than the previous year, still resulted in a levy rate $1.00/$1,000 lower than what voters approved in Walla Walla.

Looking Ahead

Although WWPS officials can not fully predict what the state rates (Part 1 and Part 2) moving forward will be, as those are under the jurisdiction of the County Assessor, levy and bond rates are under our guise. Recently, the voters approved the replacement learning levy for the 2021-2024 school years, capped at $2.50/$1,000, the same rate we are currently paying. If assessed values exceed estimates, the rate will fall below the current $2.50 amount over time. Similarly, the replacement bond that is paying for improvements at WaHi, Pioneer, and Lincoln is estimated to continue receding below the original $1.22 rate as assessed values increase across our community.

Downloadable PDF of Bar Graph Above