FAQ

What is a bond and how is it different from a levy?

“Bonds are for Building, Levies are for Learning”. Bonds are used for new school construction, renovation of buildings, and land purchases. They’re also used for major repairs & improvements such as new roofs, heating and cooling systems, and safety improvements to our schools. Bonds are voter approved debt. Money from local property taxes would be used to pay back the debt over time. Levies, “for learning,” support the daily education of our students and provide educational programming and opportunities.

How can I learn more about the total educational taxes in Walla Walla?

Click here for a detailed breakdown about the three educational taxes and the McCleary impact.

What does it take to pass a bond? Is it similar to a levy?

Bonds require a 60 percent supermajority approval to pass, while levies require a simple majority of 50% + 1.

What are the Voter Registration deadlines?

Registration & Voting

• Easy online registration at MyVote Washington

• Voter registration forms at all schools and the WWPS District Office

• October 8, 2018 - Last day for mail, online new registrations and address changes

• October 17, 2018 - Ballots mailed to homes

• October 29, 2018 - Last day for in-person voter registration

• November 6, 2018 – Election (ballots due)

What is the percentage of the bond in relation to the district’s total debt capacity?

The $65.6M bond proposal is less than 40% of the district’s total debt capacity (approx $165M)

What will you do if there are any excess funds?

Any remaining funds will be used to pay down debt and reduce the rate for taxpayers.

How much state match is the district eligible for with this proposal?

The district is eligible for approximately $52.63M in state match funds.

How does the state match process work?

Click HERE for answer.

How will the state match be used differently on this proposal?

All State Match funds will only be applied to Wa-Hi, Pioneer Middle School and Lincoln High School voter-approved projects.

Can bond funds be used for anything other than construction and building upgrades?

No. Money from bond measures is placed in the district’s capital projects fund. Per state law, money from this fund cannot be transferred to other funds or used for unrelated purposes. Monies can only be applied to the capital improvements specifically identified in the Board Resolution and Bond Ballot.

How much will the bond increase my tax rates?

This is programmed to be a replacement bond as Walla Walla Public Schools is bond debt free in December. Conservative estimates related to assessed value growth and tax collections were used in programming assumptions.

What does the legislator’s McCleary Levy Swap mean for long term state taxes?

The “Levy Swap” legislation will cut local property tax rates.

Click HERE for details.

I have heard the state property tax rate will increase to $3.60 per thousand in 2022. Is that true?

No.

However, we can understand how some people have misinterpreted future tax rates when trying to interpret Washington code and statute language. It is a bit confusing. The following is a summary of current and future state tax rates.

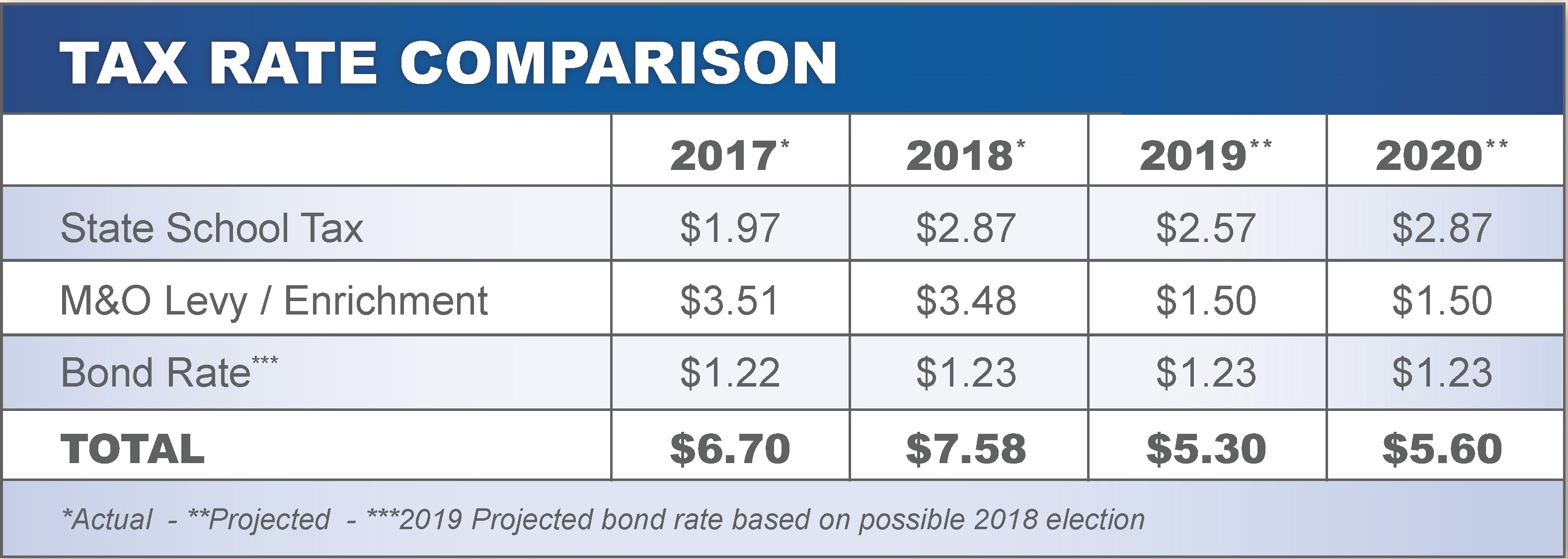

The “McCleary” changes to the state tax rate were authorized in 2018 under ESSB 6614 which increased taxes statewide. Walla Walla’s state tax rate increased approximately 90 cents per thousand from $1.97 to $2.87 in 2018. A temporary 30 cent relief in 2019 was authorized statewide ($2.57), but returns to the $2.87 rate in 2020 and 2021. Although an increase in the state rate was realized for local taxpayers, legislators also approved ESSB 6362 which capped local district levies at $1.50 per thousand, resulting in an approximate $2.00 rate decrease for Walla Walla taxpayers. Below is a chart summarizing this impact that the district maintains on its website (http://www.wwps.org/2018bond/levy-swap-impact). WWPS mailed hardcopies of this information to all box holders in its jurisdiction last spring to help inform taxpayers of this McCleary tax implication.

In 2022, the state tax rate level reverts to pre-McCleary language that addresses year to year increases. Washington Administrative Code 458-19-550 establishes that the state levy shall be $3.60 per thousand or the levy limit established in RCW 84.55.010, whichever IS LESS.

RCW 84.55.010 prescribes the limitations for year to year increases in state property tax rates. As outlined, from one year to the next, property tax rate increases cannot exceed the limit factor. The limit factor, as outlined in RCW 84.55.005, would not allow the state property tax rate to increase to the the $3.60 maximum cap. In fact, if history is any indication, it has tended to recede over time, falling considerable from its state-wide high point of $3.59 / $1,000 in 1997. This rate reduction is a result of the 1% growth limit placed on the state education tax. The limit prescribes that the state cannot collect more than 101% revenue from the previous year to the next (e.g. the 1% limit). As statewide property values continue to increase, as many of us have witnessed locally, the state is required to lower the tax rate so that they do not collect revenue in excess of the 1% budget growth factor.

For a detailed review of the education tax structure, please click HERE

For an instructional video summarizing this impact, please visit here: https://youtu.be/ph1XqMNO5lo

If you have any questions about tax implications, please do not hesitate to contact the district office at anytime.

How was it decided what would be included on the bond?

An 18 member Community Facilities Task Force spent nearly two years prioritizing facility needs. They focused on classroom and learning needs first. They took a renovation-based approach, not building new schools. The bond proposal aligned with community feedback

Am I eligible for an exemption from bond measure property taxes?

Under certain conditions, people with disabilities or citizens 61 years of age or older are eligible for a tax exemption. Consideration is given to income, ownership of taxable residence and other factors. For more information and to apply for an exemption, contact the Walla Walla County Assessor’s office.

Is there money for safety and security enhancements and at what campuses?

Yes, all campuses will see $890,000 in Safety and Security updates and improvements.

Improvements include:

• Safety, security and communication/technology network improvements - per safety audit recommendation:

• Unified emergency messaging system, necessary cabling and select communications/intercom upgrades

• Enhanced security camera coverage

• Communications and data connectivity backbone and redundancy (e.g., network ring)

• Limited fencing improvements and access control/emergency lockdown accommodations

Also, the three schools selected for renovation, Wa-Hi, Pioneer MS and Lincoln HS, will see improvements in access and visibility control, communications systems and design.

Why doesn’t the district use the tax dollars it already receives to perform these upgrades?

State only funds basic maintenance and operational costs such as general care, upkeep, and utility costs. Capital improvements and substantial renovations are meant to be paid for with community bonds.

How does the district care for its facilities now?

Annually the WWPS spends more than $5M (about 10% of its general fund budget), supporting its current assets which include ~1 million sq ft of facilities and over 150 acres of grounds, allocating 51 FTE in support of our asset preservation plan.

How can I be assured, if the bond measure passes, that bond proceeds will be spent wisely and on that for which I vote?

The district has established an independent citizen’s Bond Oversight Committee to review construction activities, project costs, and accountability of resources to ensure bond dollars are spent only on the voter approved initiatives.

Bond Oversight Committee members:

• Bonnie Bowton

• Yolanda Esquivel

• Mark Hess

• Lawson Knight

• Kim McDaniels

• Terry McConn

• Jennifer Mouat

• Dick Moeller

• Scott Morasch

• Ken Seibold

• Tony Wenham